The Side-Hustle | Freelancer's Entrepreneur Mini-Course

Making Money in the Gig Economy in 1 Day

SIDE-HUSTLING OR FREELANCING?

THIS COURSE IS ABOUT THE BUSINESS OF FREELANCING, THE SIDE-HUSTLE

YOU ARE AN ENTREPRENEUR

Know what other business people know to build your business and profitability.

Thinking about a side-hustle or are you already a freelancer, independently employed, a contractor? Are you or thinking about:

- Marketing voice over, articles and blog post, translation, video and animation services on Fiverr

- Driving for car services such as Uber or Lyft

- Selling products or services through Etsy, eBay, Amazon, or Shopify

- Working as a freelance writer, web designer, programmer, or musician

- Selling products for Mary Kay, Amway, USANA, or Pampered Chef

- Renting space in your home on sites such as Airbnb

- Selling social services, cosmetics, photography, home repairs, etc.

YOU WILL LEARN..

- The business side of freelancing;

- Understand that your side-hustle or freelance is a business that comes with the benefits of entrepreneurship;

- Discover the tax benefits afforded to you with the Tax Cuts and Jobs Act of 2017 ;

- Map out whether you incorporate your freelance business or remain as a sole proprietor.

- Current freelancers who want to know the business-side of their business

- Those engaged in a side-hustle wanting to create a freelancing business

- Anyone interested in becoming a professional freelancer

COURSE DESCRIPTION

This course begins with an introduction into how performing a side-hustle or engaging as a freelancer is a business.

You will realize that you have a business. And with this business, you have the opportunity to take control of your career, regardless of whether your freelance activity is incorporated, by seeing the world the way entrepreneurs do.

The course walks you through choosing whether to incorporate or remain as a sole proprietor. And how to take advantage of tax opportunities that are available to you so that you may maximize your profitability. By pushing yourself to think like an entrepreneur, you will drive your business from being part-time to a full-time gig. And you will attract and retain clients.

REACH YOUR POTENTIAL

Let me enlighten you. You may look at yourself as making some side money, but you have a business. YOU ARE AN ENTREPRENEUR.

-

Learn the benefits that are available to you.

- Incorporating

- Common deductions

- Vehicle deductions

- Home office deductions

- Etc.

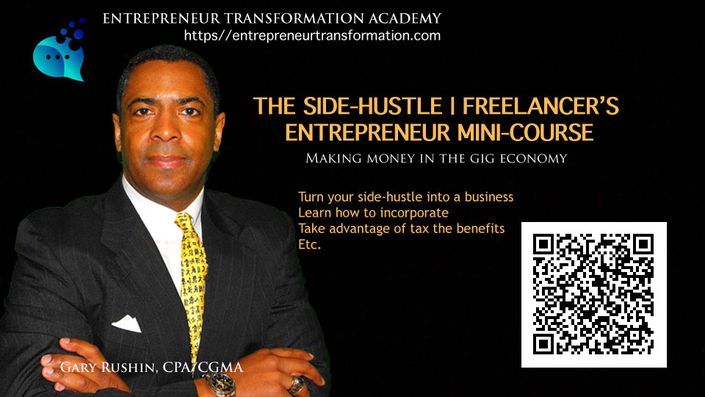

Your Instructor

Gary Rushin has dedicated his life to helping entrepreneurs find success using best-class innovative methods, tools, and techniques. Gary's breadth of experience includes leadership positions as chairman, CEO, CFO, and turnaround professional. With his expertise in mergers and acquisitions, finance, and accounting, Gary has taught at the executive MBA level in the United States, China, and India. He has served on the unsecured creditors' committees of several well-known bankruptcies. Additionally, Gary successfully saved a 70-year old insolvent manufacturer and a troubled information technology service company. Also leveraging his knowledge of technology, Gary has authored several articles and courses on technology for accountants for the American Institute of Certified Public Accountants (AICPA). Gary is a licensed certified public accountant.